Budget Suggestions For Curbing Corruption and Black Money

Budget Suggestions For Curbing Corruption and Black Money

Now, it is almost final that budget will be put on the floor of parliament on 1st February, 2017. Author through News Club also feels that his suggestions should be submitted to Finance Minister for his consideration for the development of country and in the public interest to curb the Black Money and Corruption. Therefore, Author through this article proposes his very valuable few suggestions as under in short but without going in detail –

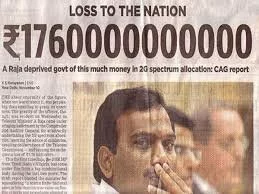

- To End the Black Money : It is settled truth that black money in India can’t be curbed and it’s generation / creation can’t be stopped on the basis of present taxation laws / systems which are creators of Black Money. Therefore, author suggests and demands as under –

- Present Income-tax Act, 1961 should be abolished completely and India should be made income-tax free. This will be proved to be the best solution to curb the black money after currency demonetization.

- If such revolutionary step like 100% Income-tax Free India can’t be taken in present circumstances, author suggests for following issues for amendment in present Income-tax Act, 1961 –

- All the incomes including presumptive Incomes u/s 44AD / 44AE etc. should be fixed for each assessee with fixed formulas without leaving any scope for manipulation.

- All the responsibilities of Income-tax Authorities and time limitations for all the actions under Income-tax Act, 1961 should be fixed in the Income-tax Act itself. Citizens Charter, CBDT Instructions / Guidelines and Office Manual etc. are meaningless for a tax-payer for seeking true justice.

- Sections / Sub-sections / Clauses in Income-tax Act, 1961 are increasing year after year and law is becoming more complicated year after year. Therefore, Income-tax Act, 1961 should be simplified so that each assessee himself can understand the law without the aid of CA or Advocate.

- Proposed GST Law should also be withdrawn or All the Traders (Doing business within State) should be made free from GST subject to Composition or fixed tax or any other formula.

- To End the Corruption : It is also settled truth that Corruption in India can’t be curbed and it’s generation can’t be stopped on the basis of present taxation laws / systems which are creators of corruption also. Therefore, Therefore, author suggests and demands as under –

- Creation of Black Money should be stopped as suggested above.

- In all the taxation laws, responsibilities / limitations of all the taxation Authorities should be fixed / defined and tax-payer should be empowered through law itself to punish those taxation Authorities who are not fulfilling their responsibilities or the demand / application / request of any tax payer should deemed to be accepted after particular fulfillment and / or time limit.

- Discretionary powers should be curtailed to the maximum extent. Discretionary powers of any authority are the main source of corruption.

If Hon’ble finance minister requires detailed explanation and arguments in depth without losing any revenue on above discussed any suggestion, Author may be called for further detailed clarification and he will be always ready to advance detailed explanations / suggestions in the nation’s interest.

Author : CA. K.C.Moondra, Emai : [email protected]

Related Post

भ्रष्टाचार व कालेधन की समाप्ति के लिए बजट – 2017 के लिए कुछ सुझाव

भ्रष्टाचार व कालेधन की समाप्ति के लिए बजट – 2017 के लिए कुछ सुझाव