1% TCS ( Income Tax ) On Transactions Above Rs. 2.00 Lakhs Relaxed

Sumerpur | Pali | Rajasthan : Considering the demands and problems of Business World of India, levy of 1% TCS ( Income Tax ) on cash payment in transactions above Rs. 2.00 Lakhs has been relaxed marginally.

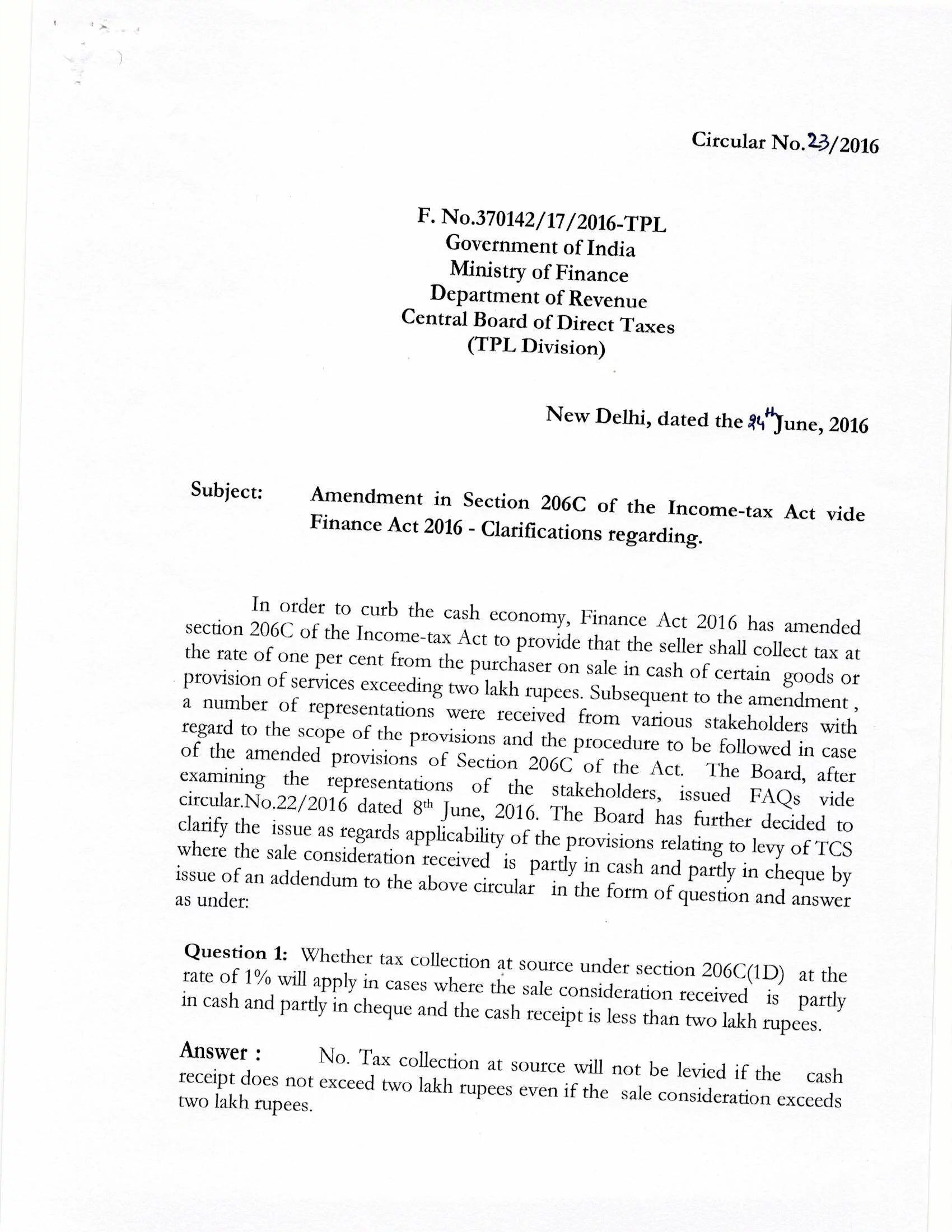

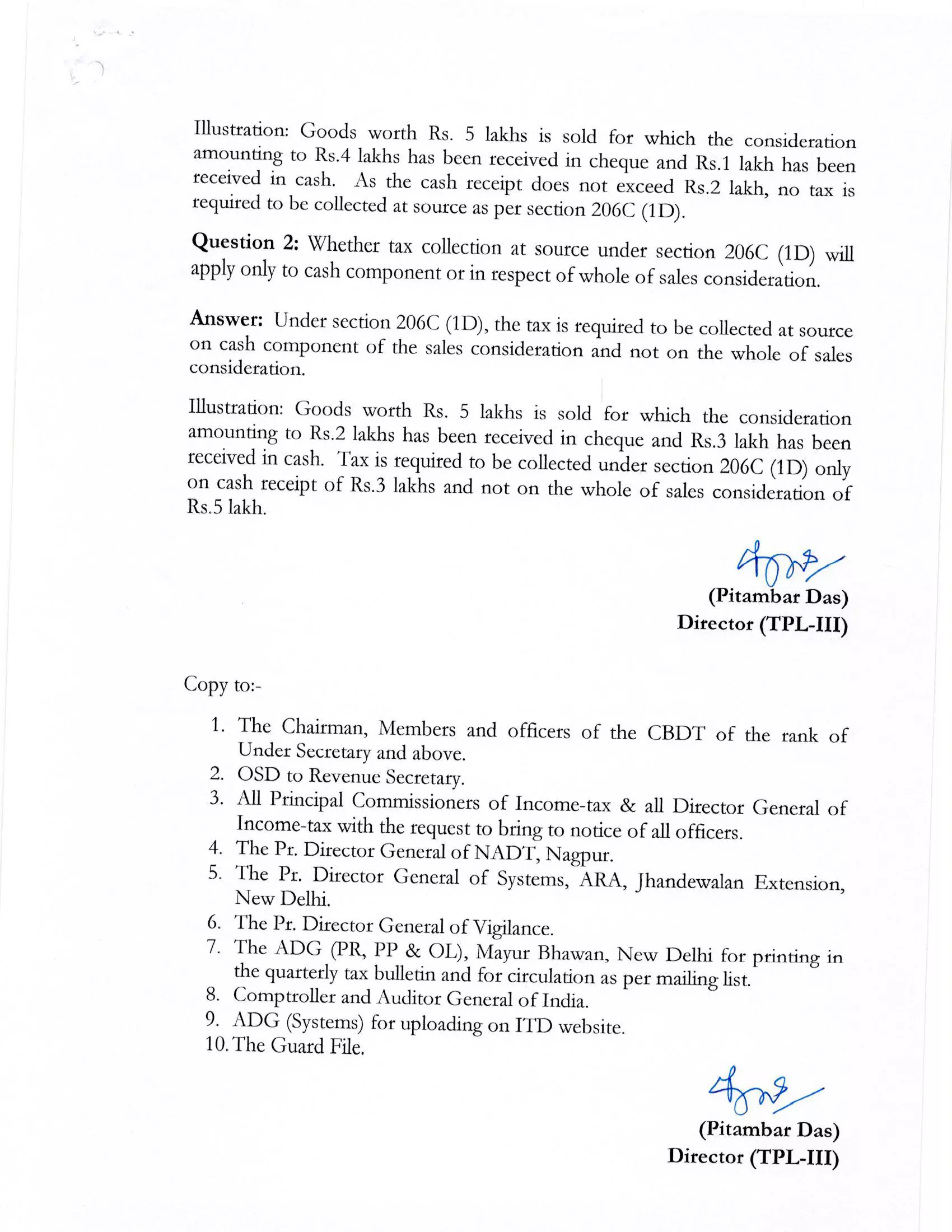

Presently, as per news provisions of section 206C (1D) of the Income-tax Act, 1961, tax is to be collected (TCS) @ 1% on cash receipt if transaction of goods or services is above Rs. 2,00,000/-. Now, Central Board Of Direct Taxes (CBDT), Delhi has relaxed the provision by issuing a circular dated 24.06.2016.

As per explanatory circular, no TCS will be required if payment is partially received less than Rs. 2.00 Lakhs in the transaction over Rs. 2.00 Lakhs. For Example, if there is sales transaction is of Rs. 5.00 Lakhs and payment of Rs. 4.00 Lakhs is received by cheque and balance Rs. 1.00 Lakh is received in cash, in that cash no TCS will be required.

Likely, if there is sales transaction of Rs. 5.00 Lakhs and payment of Rs. 2.00 Lakhs is received by cheque and balance Rs. 3.00 Lakh is received in cash, in that TCS will be required @ 1% on this amount of Rs. 3.00 Lakhs only.

Related Post

दो लाख से अधिक के सौदों पर आयकर वसूली-कटोती (TCS) पर आंशिक छूट- धारा 206 सी (1डी)

दो लाख से अधिक के सौदों पर आयकर वसूली-कटोती (TCS) पर आंशिक छूट- धारा 206 सी (1डी)