Obtaining Income Surrender In Income Tax Search / Survey Is Unlawful

Daily news strories can be read / heard about surrender of income during the income-tax search and survey operations but obtaining income surrender in Incometax Search / Survey is totally unlawful.

In fact, search and survey action is carried out by incometax authorities u/s 132 and 133A of the Income-tax Act, 1961 respectively for unearthing the undisclosed incomes / black money but there is no provision under these sections which empowers incometax authorities to get confessional surrender of income during search and survey actions. Despite these facts, incometax authorities are obtaining confessional surrender of income for last many years which is nothing but a matter of unlawfulness, harassment and excessiveness.

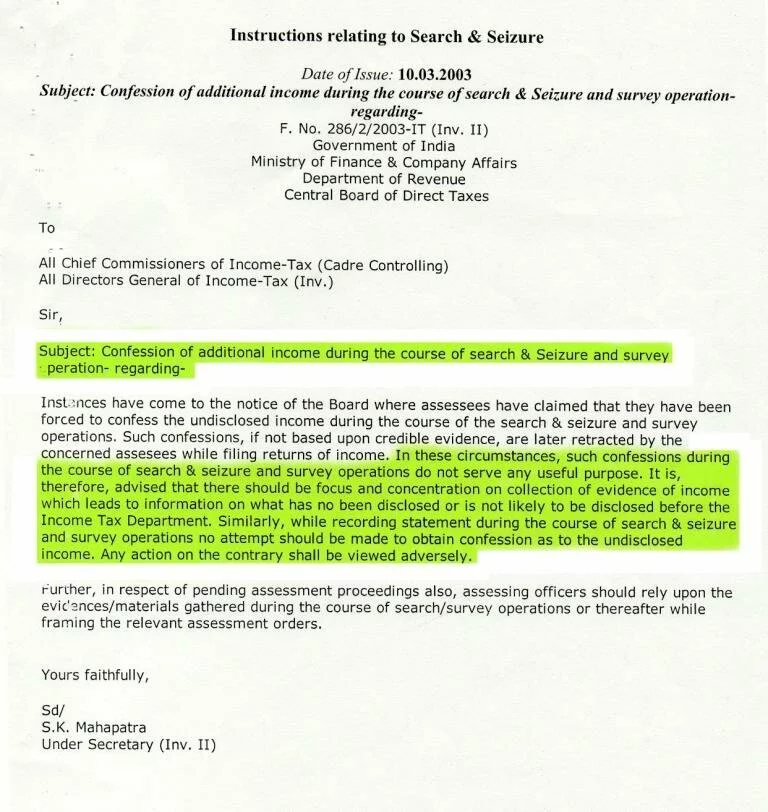

Not only this, CBDT (Central Board Of Direct Taxes, New Delhi), the highest authority of Income Tax Department has specifically issued instruction No. F.No.286/2/2003-IT (INV.II) dated 10.03.2003 and directed all such income Tax Autrhorities for not taking any confessional surrender of income during the search and survey proceedings. Despite such a binding CBDT instruction, if any confessional surrender is obtained by the Income Tax Authorities, such surrender is totally unlawful.

Readers may read exact content of Instruction No. F.No.286/2/2003-IT (INV.II) dated 10.03.2003 hereunder and can estimate and imagine, how government machinery is working so openly in this Modi regime also?

Allegation of Taking Money Rs. 2.00 Lakhs by ITO Shailendra Bhandari

Allegation of Taking Money Rs. 2.00 Lakhs by ITO Shailendra Bhandari