Indian Government’s BHIM APP – What is it and how does it work (BHIM-1) ?

Indian Government’s BHIM APP – What is it and how does it work (Bhim – 1) ?

We all have heard stories about strength of mighty ‘Bhim’ of Treta Yug. However, todays ‘BHIM’ can prove to be stronger than him also. Yes, today’s ‘BHIM’ is no human but a Mobile App by the Govt. of India which has been launched by Prime Minister Narendra Modi on 30-12-2016. This’BHIM App’ is indeed a precious New Year gift by P.M. Modi.

‘BHIM’ is a kind of Mobile Bank which enables you to send and receive money anytime (i.e. 24×7) through your mobile phone in just few seconds. This means your mobile number is your mobile bank. Presently, 32 Banks are connected with this App. Thus, this App is useful to you if you have an account in any of these 32 Banks.

Presently, around 50 such type of ‘Mobile Bank Apps’ are available in Indian Market which you can download on your phone. ‘BHIM’ is not a product of any foreign company but a 100% ‘Indian App’ created by National Payments Corporation of India (NPCI) which works under the supervision of Reserve Bank of India (RBI). Presently, the transaction limits under this App is maximum Rs. 20000/- per day and single transaction limit of Rs. 10000/-.

Requirements to use ‘BHIM App’ –

> 1. The person making payment (you, Payer) should have his Mobile Number registered in his Bank Account.

>2. You must have Debit Card related to your Online Bank Account.

> 3. The person / company receiving payment (Receiver) must also have his mobile number registered in his Bank Account.

> 4. Payer and Receiver person / company, both must be registered with ‘BHIM App’.

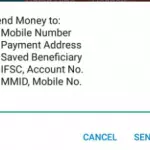

How to Download and Use ‘BHIM App’ –

Step 1: Firstly download ‘BHIM App’ in your Mobile by either clicking on the below link or from Google Play Store

https://play.google.com/store/apps/details?id=in.org.npci.upiapp

Step 2: As soon as you open the App, it will ask you to select language. Presently , 2 language options – English and Hindi are available. After selecting your preferred language click on Next – Next to continue forward.

Step 3: Now, the BHIM App will request you to allow to send a SMS to verify your Mobile Number.

Step 4: After Mobile Number Verification, the BHIM App will ask you to set a 4 digit Password.

Step 5: Once the password is set, a list of all the banks associated with BHIM shall open. First select your Bank and then select your Account.

Step 6: Now, you will be required to set a M-PIN i.e. a 4 digit password for your Bank Account.

Step 7: Now you are ready to send – receive money through BHIM App.

After downloading and activating the BHIM App completely, you can use this App even without Internet. This special feature of BHIM App makes it better than all other Mobile Bank Apps. To activate / use this feature, simply dial *99# on you mobile screen and follow the steps as displayed.

On searching the internet, it is found that presently there are no charges on transactions through this App i.e. this App is completely free. Certain advance features of BHIM App will be launched soon after which this App will work with your Thumb Impression also. Looks like in near future NEFT, RTGS, Net-Banking will be words of past – CA Deepika Moondra (to be continued…..)

Related Post

भीम (BHIM) की खुबिया क्या है व इसकी कमिया क्या-क्या है (भीम-4) ?

भीम (BHIM) की खुबिया क्या है व इसकी कमिया क्या-क्या है (भीम-4) ?

भीम एप्प (BHIM) डाउनलोड करने के बाद केसे बैंक व्यवहार करता है (भीम-3) ?

भीम एप्प (BHIM) डाउनलोड करने के बाद केसे बैंक व्यवहार करता है (भीम-3) ?