Effect of Non-declaration of Old Incomes / Assets

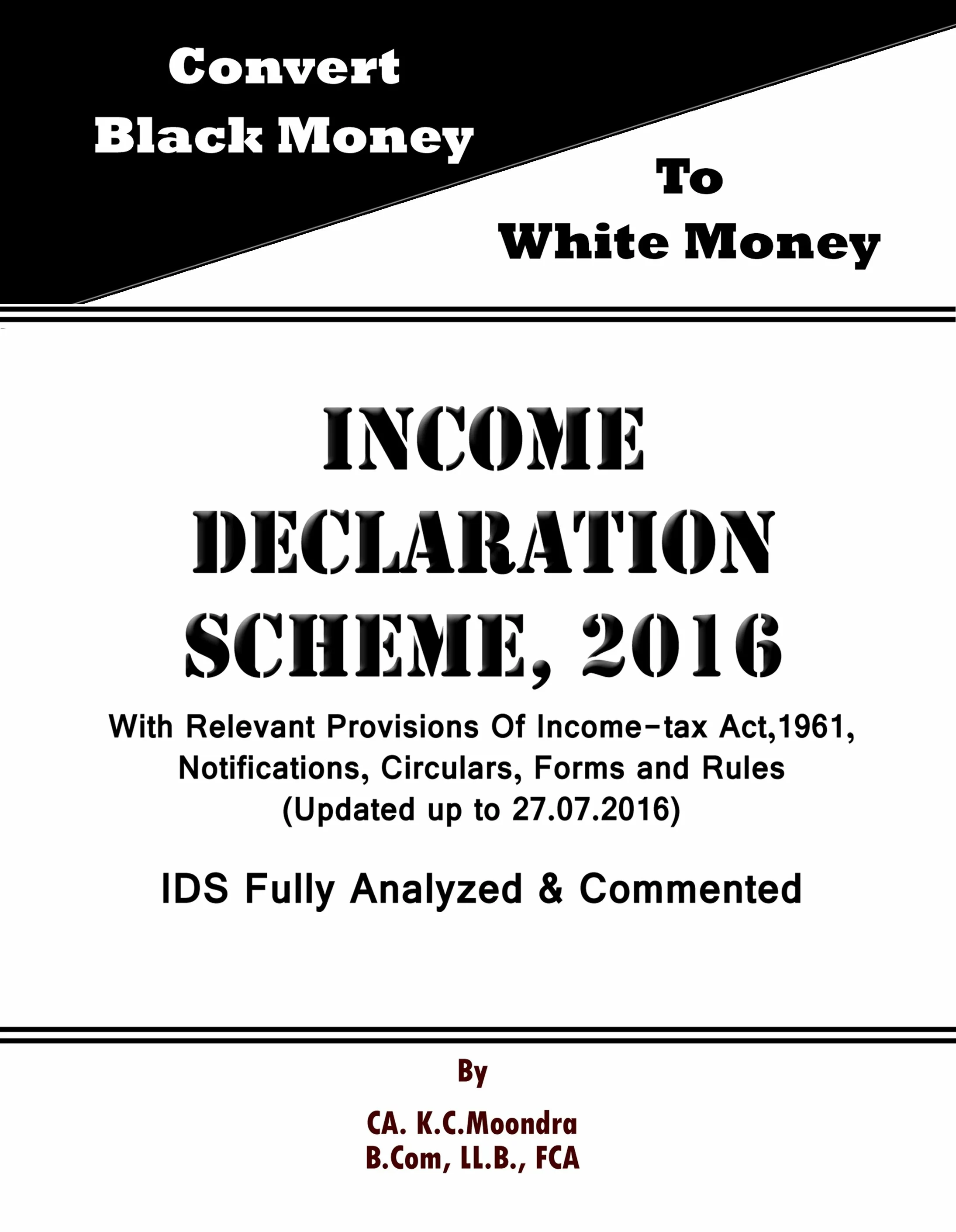

Manish Mewara from Jaipur : Recently an online Book of CA. K.C.Moondra on Income Declaration Scheme, 2016 has been published. In the Chapter 10 of this book, he has explained the effects of non-declaration / non-disclosure of old period of incomes / assets which is covered by this scheme. As per this book incomes since 01.04.1940 is covered by this scheme. Contents of that chapter-10 are being reproduced here under for the ready reference of all the readers –

Now-a-days, it can be heard even Prime Minister Narendra modi is saying, “Disclose undisclosed income, otherwise be ready to face consequences”. Therefore, it is necessary to know about these consequences. And for this purpose, first we should go through the Income Disclosure Scheme and the scheme explaining circulars. Relevant portion of such provisions are being produced here under to learn all about the consequences –

- The Finance Act, 2016

Removal Of Doubts.

For the removal of doubts, it is hereby declared that—

(a) save as otherwise expressly provided in sub-section (1) of section 183, nothing contained in this Scheme shall be construed as conferring any benefit, concession or immunity on any person other than the person making the declaration under this Scheme;

(b) where any declaration has been made under section 183 but no tax, surcharge and penalty referred to in section 184 and section 185 has been paid within the time specified under section 187, the undisclosed income shall be chargeable to tax under the Income-tax Act in the previous year in which such declaration is made;

(c) where any income has accrued, arisen or received or any asset has been acquired out of such income prior to commencement of this Scheme, and no declaration in respect of such income is made under this Scheme,—

- such income shall be deemed to have accrued, arisen or received, as the case may be; or

- the value of the asset acquired out of such income shall be deemed to have been acquired or made, in the year in which a notice under section 142, sub-section (2) of section 143 or section 148 or section 153A or section 153C of the Income-tax Act is issued by the Assessing Officer, and the provisions of the Income-tax Act shall apply accordingly.

- Circular-cum-FAQs

Circular No. 17 of 2016 dated 20.05.2016

Question No. 8: What are the consequences if no declaration under the Scheme is made in respect of undisclosed income prior to the commencement of the Scheme?

Answer: As per section 197(c) of the Finance Act, 2016, where any income has accrued or arisen or received or any asset has been acquired out of such income prior to the commencement of the Scheme and no declaration is made under the Scheme, then such income shall be deemed to have been accrued, arisen or received or the value of the asset acquired out of such income shall be deemed to have been acquired in the year in which a notice under section 142/143(2)/148/153A/153C is issued by the Assessing Officer and the provisions of the Income-tax Act shall apply accordingly.

Question No. 9: If a declaration of undisclosed income is made under the Scheme and the same was found ineligible due to the reasons listed in section 196 of the Finance Act, 2016, then will the person be liable for consequences under section 197(c) of the Finance Act, 2016?

Answer : In respect of such undisclosed income which has been duly declared in good faith but not found eligible, then such income shall not be hit by section 197(c) of the Finance Act, 2016. However, such undisclosed income may be assessed under the normal provisions of the Income Tax Act, 1961.

Question No. 10: If a person declares only a part of his undisclosed income under the Scheme, then will he get immunity under the Scheme in respect of the part income declared?

Answer: It is expected that one should declare all his undisclosed income. However, in such a case the person will get immunity as per the provisions of the Scheme in respect of the undisclosed income declared under the Scheme and no immunity will be available in respect of the undisclosed income which is not declared.

Circular No. 24 of 2016 dated 27.06.2016

Question No. 4: If undisclosed income relating to an assessment year prior to A.Y. 2016-17, say A.Y. 2001-02 is detected after the closure of the Scheme, then what shall be the treatment of undisclosed income so detected?

Answer: As per the provisions of section 197(c) of the Finance Act, 2016, such income of A.Y. 2001-02 shall be assessed in the year in which the notice under section 148 or 153A or 153C, as the case may be, of the Income-tax Act is issued by the Assessing Officer. Further, if such undisclosed income is detected in the form of investment in any asset then value of such asset shall be as if the asset has been acquired or made in the year in which the notice under section 148/153A/153C is issued and the value shall be determined in accordance with rule 3 of the Rules.

Circular No. 27 of 2016 dated 14.07.2016

Question No. 2: If an undisclosed income represented in the form of an asset or otherwise pertains to a year falling beyond the time limit allowed under section 149 of the Income-tax Act, 1961 and the said undisclosed income is not declared under the Scheme, then as per the provisions of section 197(c) of the Finance Act, 2016, the said undisclosed income shall be treated as the income of the year in which a notice under section 148 of the Income-tax Act has been issued. The said provision is inconsistent with the existing time lines provided under the Income-tax Act for reopening a case. Please clarify?

Answer: Question No. 4 of Circular No. 24 of 2016 may be referred where the tax treatment of such income has been clarified. Since the Scheme contained in Chapter IX of the Finance Act, 2016 is a later law in time, the provisions of the Scheme shall prevail over the provisions of earlier laws.

- Income-tax Act, 1961

Time limit for notice (For Reopening the Cases).

- (1) No notice undersection 148 shall be issued for the relevant assessment year,—

(a) if four years have elapsed from the end of the relevant assessment year, unless the case falls under clause (b) or clause (c);

(b) if four years, but not more than six years, have elapsed from the end of the relevant assessment year unless the income chargeable to tax which has escaped assessment amounts to or is likely to amount to one lakh rupees or more for that year;

(c) if four years, but not more than sixteen years, have elapsed from the end of the relevant assessment year unless the income in relation to any asset (including financial interest in any entity) located outside India, chargeable to tax, has escaped assessment.

Explanation.—In determining income chargeable to tax which has escaped assessment for the purposes of this sub-section, the provisions of Explanation 2 of section 147 shall apply as they apply for the purposes of that section.

(2) The provisions of sub-section (1) as to the issue of notice shall be subject to the provisions of section 151.

(3) If the person on whom a notice under section 148 is to be served is a person treated as the agent of a non-resident under section 163 and the assessment, reassessment or recomputation to be made in pursuance of the notice is to be made on him as the agent of such non-resident, the notice shall not be issued after the expiry of a period of six years from the end of the relevant assessment year.

Explanation.—For the removal of doubts, it is hereby clarified that the provisions of sub-sections (1) and (3), as amended by the Finance Act, 2012, shall also be applicable for any assessment year beginning on or before the 1st day of April, 2012.

Repeals and Savings.

- (1) The Indian Income-tax Act, 1922 (11 of 1922), is hereby repealed.

(2) Notwithstanding the repeal of the Indian Income-tax Act, 1922 (11 of 1922) (hereinafter referred to as the repealed Act),—

(a) where a return of income has been filed before the commencement of this Act by any person for any assessment year, proceedings for the assessment of that person for that year may be taken and continued as if this Act had not been passed;

(b) where a return of income is filed after the commencement of this Act otherwise than in pursuance of a notice under section 34 of the repealed Act by any person for the assessment year ending on the 31st day of March, 1962, or any earlier year, the assessment of that person for that year shall be made in accordance with the procedure specified in this Act;

(c) any proceeding pending on the commencement of this Act before any income-tax authority, the Appellate Tribunal or any court, by way of appeal, reference, or revision, shall be continued and disposed of as if this Act had not been passed;

(d) where in respect of any assessment year after the year ending on the 31st day of March, 1940,—

(i) a notice under section 34 of the repealed Act had been issued before the commencement of this Act, the proceedings in pursuance of such notice may be continued and disposed of as if this Act had not been passed;

(ii) any income chargeable to tax had escaped assessment within the meaning of that expression in section 147 and no proceedings under section 34 of the repealed Act in respect of any such income are pending at the commencement of this Act, a notice under section 148 may, subject to the provisions contained in section 149 or section 150, be issued with respect to that assessment year and all the provisions of this Act shall apply accordingly;

Conclusion and Comments:

Intention of Provisions of Income Declaration scheme and its supportive circulars is very clear. According to these provisions, Modi Government has threatened 4 times in writing in addition to many oral threats. In case of non-disclosure of any old undisclosed income since 01.04.1940 and till 31.03.2016, all the cases will be reopened u/s 147 / 148 of the Income-tax Act, 1961 and limitation provisions of sec. 149 of the Income-tax Act, 1961 will be meaningless and will be scrapped for those who are covered by this scheme.

Hope this threat will hit by the Indian Judiciary. Let us see how many hunting can be done by the Modi Government till the final interference of Indian judiciary. Authors are very hopeful that this law nullifying the provisions of sec. 149 of the Income-tax Act, 1961 will be scrapped very easily by the Indian judiciary in near future.

Related Post

घटिया ड्राफ्टिंग, अस्पष्टता तथा भ्रमो से भरपूर है आय घोषणा स्कीम, 2016

घटिया ड्राफ्टिंग, अस्पष्टता तथा भ्रमो से भरपूर है आय घोषणा स्कीम, 2016