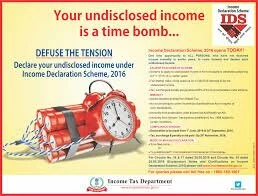

Income Declaration Scheme – Declaration Old Incomes since 01.04.1940

Manish Mewara from Jaipur : Recently an online Book of CA. K.C.Moondra on Income Declaration Scheme, 2016 has been published. In the Chapter 9 of this book, he has explained the old period of incomes / assets which is covered by this scheme. As per this book incomes since 01.04.1940 is covered by this scheme. Contents of that chapter-9 are being reproduced here under for the ready reference of all the readers-

Period of Declaration regarding Old Incomes and Investments in Assets is the hottest issue. As per the provisions of scheme, income relevant to entire period till 31.03.2016 is covered under the umbrella of the scheme. Before commenting on the issue, we would like to reproduce hereunder all the relevant provisions of schemes and circulars for better understanding –

- As per the Finance Act, 2016

Declaration of undisclosed Income.

- (1) Subject to the provisions of this Scheme, any person may make, on or after the date of commencement of this Scheme but before a date to be notified by the Central Government in the Official Gazette, a declaration in respect of any income chargeable to tax under the Income-tax Act for any assessment year prior to the assessment year beginning on the 1st day of April, 2017—

- for which he has failed to furnish a return under section 139 of the Income-tax Act;

- which he has failed to disclose in a return of income furnished by him under the Income-tax Act before the date of commencement of this Scheme;

- which has escaped assessment by reason of the omission or failure on the part of such person to furnish a return under the Income-tax Act or to disclose fully and truly all material facts necessary for the assessment or otherwise.

(2) Where the income chargeable to tax is declared in the form of investment in any asset, the fair market value of such asset as on the date of commencement of this Scheme shall be deemed to be the undisclosed income for the purposes of sub-section (1).

(3) The fair market value of any asset shall be determined in such manner, as may be prescribed.

(4) No deduction in respect of any expenditure or allowance shall be allowed against the income in respect of which declaration under this section is made.

Removal of Doubts.

- For the removal of doubts, it is hereby declared that—

(a) save as otherwise expressly provided in sub-section (1) of section 183, nothing contained in this Scheme shall be construed as conferring any benefit, concession or immunity on any person other than the person making the declaration under this Scheme;

(b) where any declaration has been made under section 183 but no tax, surcharge and penalty referred to in section 184 and section 185 has been paid within the time specified under section 187, the undisclosed income shall be chargeable to tax under the Income-tax Act in the previous year in which such declaration is made;

(c) where any income has accrued, arisen or received or any asset has been acquired out of such income prior to commencement of this Scheme, and no declaration in respect of such income is made under this Scheme,—

- such income shall be deemed to have accrued, arisen or received, as the case may be; or

- the value of the asset acquired out of such income shall be deemed to have been acquired or made,

in the year in which a notice under section 142, sub-section (2) of section 143 or section 148 or section 153A or section 153C of the Income-tax Act is issued by the Assessing Officer, and the provisions of the Income-tax Act shall apply accordingly.

- As per Circulars / FAQs on Income Declaration Scheme, 2016

Circular No. 17 of 2016 dated 20.05.2016

Question No. 8: What are the consequences if no declaration under the Scheme is made in respect of undisclosed income prior to the commencement of the Scheme?

Answer: As per section 197(c) of the Finance Act, 2016, where any income has accrued or arisen or received or any asset has been acquired out of such income prior to the commencement of the Scheme and no declaration is made under the Scheme, then such income shall be deemed to have been accrued, arisen or received or the value of the asset acquired out of such income shall be deemed to have been acquired in the year in which a notice under section 142/143(2)/148/153A/153C is issued by the Assessing Officer and the provisions of the Income-tax Act shall apply accordingly.

Question No. 9: If a declaration of undisclosed income is made under the Scheme and the same was found ineligible due to the reasons listed in section 196 of the Finance Act, 2016, then will the person be liable for consequences under section 197(c) of the Finance Act, 2016?

Answer: In respect of such undisclosed income which has been duly declared in good faith but not found eligible, then such income shall not be hit by section 197(c) of the Finance Act, 2016. However, such undisclosed income may be assessed under the normal provisions of the Income-tax Act, 1961.

Question No. 10: If a person declares only a part of his undisclosed income under the Scheme, then will he get immunity under the Scheme in respect of the part income declared?

Answer: It is expected that one should declare all his undisclosed income. However, in such a case the person will get immunity as per the provisions of the Scheme in respect of the undisclosed income declared under the Scheme and no immunity will be available in respect of the undisclosed income which is not declared.

Circular No. 24 of 2016 dated 27.06.2016

Question No. 4: If undisclosed income relating to an assessment year prior to A.Y. 2016-17, say A.Y. 2001-02 is detected after the closure of the Scheme, then what shall be the treatment of undisclosed income so detected?

Answer: As per the provisions of section 197(c) of the Finance Act, 2016, such income of A.Y. 2001-02 shall be assessed in the year in which the notice under section 148 or 153A or 153C, as the case may be, of the Income-tax Act is issued by the Assessing Officer. Further, if such undisclosed income is detected in the form of investment in any asset then value of such asset shall be as if the asset has been acquired or made in the year in which the notice under section 148/153A/153C is issued and the value shall be determined in accordance with rule 3 of the Rules.

Circular No. 27 of 2016 dated 14.07.2016

Question No. 2: If an undisclosed income represented in the form of an asset or otherwise pertains to a year falling beyond the time limit allowed under section 149 of the Income-tax Act, 1961 and the said undisclosed income is not declared under the Scheme, then as per the provisions of section 197(c) of the Finance Act, 2016, the said undisclosed income shall be treated as the income of the year in which a notice under section 148 of the Income-tax Act has been issued. The said provision is inconsistent with the existing time lines provided under the Income-tax Act for reopening a case. Please clarify?

Answer: Question No. 4 of Circular No. 24 of 2016 may be referred where the tax treatment of such income has been clarified. Since the Scheme contained in Chapter IX of the Finance Act, 2016 is a later law in time, the provisions of the Scheme shall prevail over the provisions of earlier laws.

Hottest Disputed Issue and Conclusion : From the commulative readings of above mentioned provisions of Finance Act, 2016, three Circulars-cum-FAQs and threats of Prime Minister Shri Narendra Modi and Finance Minister Shri Arun Jaitaly in their speeches, it is clear that Indian Government intends to tax on all the undisclosed incomes earned between 01.04.1940 to 31.03.2016 against all the settled laws and principles ?

Related Post

घटिया ड्राफ्टिंग, अस्पष्टता तथा भ्रमो से भरपूर है आय घोषणा स्कीम, 2016

घटिया ड्राफ्टिंग, अस्पष्टता तथा भ्रमो से भरपूर है आय घोषणा स्कीम, 2016