The Prohibition of Benami Property Transactions Rules, 2016

The Prohibition of Benami Property Transactions Act, 1988 (Click Here )

The Prohibition of Benami Property Transactions Act, 1988 (Click Here )

The Prohibition of Benami Property Transactions Rules, 2016

- Short title and commencement.—(1) These rules may be called the Prohibition of Benami Property Transactions Rules, 2016.

(2) They shall come into force on the 1st day of November, 2016.

Definitions.—(1) In these rules, unless the context otherwise requires,-

(a) “Act” means the Prohibition of Benami Property Transactions Act, 1988 (45 of 1988);

(b) “Chapter” means a Chapter of the Act;

(c) “Form” means a Form appended to these rules; and

(d) “Section” means a section of the Act.

(2) Words and expressions used and not defined in these rules but defined in the Act, the Indian Trusts Act, 1882 (2 of 1882), the Indian Succession Act, 1925 ( 39 of 1925), the Indian Partnership Act, 1932 (9 of 1932), the Income-tax Act, 1961(43 of 1961), the Depositories Act, 1996 (22 of 1996), the Prevention of Money-Laundering Act, 2002 (15 of 2003), the Limited Liability Partnership Act, 2008 (6 of 2009) and the Companies Act, 2013 (18 of 2013) or the rules made under those Acts, shall have the same meanings respectively assigned to them in those Acts and rules.

- Determination of price in certain cases.—(1) For the purposes of sub- clause(ii) of clause (16) of the section 2 of the Act, the price shall be determined in the following manner, namely:—

(a) the price of unquoted equity shares shall be the higher of,—

(I) its cost of acquisition;

(II) the fair market value of such equity shares determined, on the date of transaction, by a merchant banker or an accountant as per the Discounted Free Cash Flow method; and

(III) the value, on the date of transaction, of such equity shares as determined in the following manner, namely:—

The fair market value of unquoted equity shares = (A+B – L)× (PV)/(PE)

where,

A= book value of all the assets (other than bullion, jewellery, precious stone, artistic work, shares, securities and immovable property) as reduced by,-

(i) any amount of income-tax paid, if any, less the amount of income-tax refund claimed, if any, and

(ii) any amount shown as asset including the unamortised amount of deferred expenditure which does not represent the value of any asset;

B= the price that the bullion, jewellery, precious stone, artistic work, shares, securities and immovable property would ordinarily fetch on sale in the open market on the date of transaction;

L= book value of liabilities, but not including the following amounts, namely:—

(i) the paid-up capital in respect of equity shares;

(ii) the amount set apart for payment of dividends on preference shares and equity shares;

(iii) reserves and surplus, by whatever name called, even if the resulting figure is negative, other than those set apart towards depreciation;

(iv) any amount representing provision for taxation, other than amount of income-tax paid, if any, less the amount of income- tax claimed as refund, if any, to the extent of the excess over the tax payable with reference to the book profits in accordance with the law applicable thereto;

(v) any amount representing provisions made for meeting liabilities, other than ascertained liabilities;

(vi) any amount representing contingent liabilities other than arrears of dividends payable in respect of cumulative preference shares;

PE = total amount of paid up equity share capital as shown in the balance-sheet;

PV= the paid up value of such equity shares;

4. Furnishing of Information.—For the purpose of sub-section (2) of section 21, the income-tax authority referred to in sub-section (1) of the section 285BA of Income-tax Act, 1961 (43 of 1961) or such other authority or agency which is prescribed under sub-section (1) of section 285BA shall electronically transmit a copy of statement received by it under sub-section (1) of section 285BA of that Act to the Initiating Officer or such authority or agency authorised by the Initiating officer on or before fifteen days from the end of the month in which said statement is received.

- Provisional attachment.—For the purposes of sub-section (3) of section 24, the Initiating Officer shall provisionally attach any property in the manner provided in the Second Schedule of Income-tax Act, 1961(43 of 1961).

- Confiscation of property under second proviso to sub-section (1) of section 27.— (1) Where an order of confiscation of property under sub-section (1) of section 27 has been made, the Adjudicating Authority shall send a copy of the order to the Authorised Officer.

(2) Where an order referred to in sub-rule (1) has been received by the Authorised Officer in respect of any immovable property, he shall,-

(i) forthwith issue notice to the authority of the Central Government or a State Government, as case may be, having jurisdication for the purposes of registration of such immovable property, intimating about the confiscation of the property;

(ii) arrange to place copy of the notice at some conspicuous part of the immovable property for the benefit of general public mentioning clearly therein, in English and in vernacular language, that the property has been confiscated under the Act and vests absolutely in the Central Government;

(iii) arrange to make a proclamation for the confiscation of immovable property at some place on or near such property by beat of drum or other customary mode.

(3) Where an order referred to in sub-rule (1) has been received by the Authorised Officer in respect of any movable property, he shall,-

(i) forthwith issue a notice to the authority or person having the custody of such movable property informing him about the confiscation of such property; or

(ii) sell the property, if the property is liable to speedy and natural decay or the expenses for maintenance is likely to exceed its value, with the leave of the concerned Adjudicating Authority, and deposit the sale proceeds in the nearest Government Treasury or branch of the State Bank of India or its subsidiaries or in any nationalised bank in fixed deposit and retain the receipt thereof:

Provided that where the owner of the property furnishes the fixed deposit receipt of State Bank of India or its subsidiaries or a nationalised bank equivalent to the value of property in the name of Administrator, the authorised officer may accept and retain such fixed deposit receipt as security:

Provided further that where the movable property is a mode of conveyance of any description, the authorised officer, after obtaining its valuation report from the Motor Licensing Authority or any other authority, as the case may be, may accept and retain the fixed deposit receipt of State Bank of India or its subsidiaries or a nationalised bank, equivalent to the value of the movable property as security in the name of Administrator;

(iii) cause to deposit the property consisting of cash, Government or other securities or bullion or jewellery or other valuables in a locker in the name of the Administrator or in the form of fixed deposit, as the case may be, in State Bank of India or its subsidiaries or in any nationalised bank and retain the receipt thereof;

(iv) cause to get the property in the form of shares, debentures, units of Mutual Fund or instruments to be transferred in favour of Administrator;

(v) issue a direction to the bank or financial institution, as the case may be, to transfer and credit the money to the account of the Administrator, where the property is in the form of money lying in a bank or a financial institution.

Explanation.– For the purposes of this rule, an “Authorised Officer” means an Income Tax Officer who is authorised by the Adjudicating Authority in this behalf.

- Receipt of confiscated property under sub-section (1) of section 28.—The Administrator shall, at the time of receiving the confiscated property, ensure proper identification of such property with reference to its particulars mentioned in the order made under sub-section (1) of section 27.

- Management of confiscated property under sub-section (1) of section 28.—(1) Where the property confiscated is of such a nature that its removal from the place of attachment is impracticable or its removal involves expenditure out of proportion to the value of the property, the Administrator shall arrange for the proper maintenance and custody of the property at the place of its attachment.

(2) If the property confiscated consists of cash, Government or other securities, bullion, jewellery or other valuables, the Administrator shall cause to deposit them for safe custody in the nearest Government Treasury or a branch of the Reserve Bank of India or the State Bank of India or its subsidiaries or in any authorised bank.

(3) The Administrator shall maintain a register containing the details in Form No. 1 annexed to these rules for recording entries in respect of moveable property, such as cash, Government or other securities, bullion, jewellery or other valuables.

(4) The Administrator shall obtain a receipt from the Treasury or the bank, as the case may be, against the deposit of moveable properties stated in sub-rule (2).

(5) The Administrator shall maintain a register containing the details in Form No. 2 annexed to these rules for recording entries in respect of property other than the properties referred to in sub-rule (2).

- Disposal of confiscated property under sub-section (3) of section 28.— Where the Central Government directs that the property vested in it under sub-section (3) of section 27 be disposed of, then, the administrator shall arrange to dispose of the property in the manner provided in the Second Schedule to the Income-tax Act, 1961(43 of 1961).

- Appeals to the Appellate Tribunal.—(1) An appeal to the Appellate Tribunal under sub-section (1) of section 46 of the Act shall be filed in Form No. 3 annexed to these rules.

(2) At the time of filing, every appeal shall be accompanied by a fee of ten thousand rupees.

(3) The appeal shall set forth concisely and under distinct head the grounds of objection to the order appealed against and such grounds shall be numbered consecutively; and shall specify the address of service at which notice or other processes of the Appellate Tribunal may be served on the appellant and the date on which the order appealed against was served on the appellant.

(4) Where the appeal is preferred after the expiry of the period of forty-five days referred to in sub-section (1) of section 46, it shall be accompanied by a petition, in quadruplicate, duly verified and supported by the documents, if any, relied upon by the appellant, showing cause as to how the appellant had been prevented from preferring the appeal within the period of forty- five days.

FORM 1

[See rule. 8(3)]

MANAGEMENT OF CONFISCATED PROPERTY REGISTER (MOVEABLE).

Order number:

Date of receipt of properties:

Description of properties (quantity, amount, estimated value):

Name(s) and address(es) of the benamidar and beneficial owner, if his identity is known:

Name and address of the Treasury or bank where the properties are deposited for safe custody:

Date and time of deposit of confiscated properties in the Treasury or bank:

Receipt number with date of the receipt obtained from the Treasury or bank:

Remarks of the Administrator:

(Signature of the Administrator)

Name of the Administrator

Date:

(Seal)

FORM 2

[See rule. 8(5)]

MANAGEMENT OF CONFISCATED PROPERTY REGISTER (IMMOVEABLE)

Order Number:

Date of receipt of properties: Description of properties:

(In case of land:- area, survey number, plot number, location and complete address. In case of building: house number, location and complete address)

Name(s) and address(es) of the benamidar and beneficial owner, if his identity is known:

Remarks of the Administrator:

(Signature of the Administrator)

Name of the Administrator

Date:

(Seal)

F O R M 3

[See rule10(1)]

From

(Mention name and address of the appellant here).

To

The Registrar,

Appellate Tribunal

(Address)

Sir,

The above-named appellant, begs to prefer this appeal under section 46 of the Prohibition of Benami Property Transactions Act, 1988 against order Number dated passed by the Adjudicating Authority (address of Adjudicating Authority) under the said Act on the following facts and grounds.

FACTS

(Mention briefly the facts of the case here. Enclose copy of the order passed by the or Adjudicating Authority and copies of other relevant documents, if any.)

GROUNDS

(Mention here the grounds on which appeal is preferred).

PRAYER

In the light of what is stated above, the appellant prays for the following relief:-

RELIEF SOUGHT

(Specify the relief sought)

DECLARATION

The fee payable for this appeal as mentioned in sub-rule (2) of rule 10 has been deposited in the form of demand draft with the Registrar, Appellate Tribunal, ……………………………………..(Address) vide receipt number dated .

(Signature of the Appellant)

(Name of the Appellant)

VERIFICATION

I……………………… the appellant, do hereby declare that the facts stated above are true to the best of my information and belief.

Verified today the ……………………………… day of ………………………

(Signature of the Appellant)

(Name of the Appellant)

List of documents:

Place:

Date:

Related Post

-

‘बेनामी सम्पति’ (Benami Property) व ‘बेनामी संव्यवहार’ (Benami Transaction) में क्या क्या शामिल है (बेनामी भाग-2)

‘बेनामी सम्पति’ (Benami Property) व ‘बेनामी संव्यवहार’ (Benami Transaction) में क्या क्या शामिल है (बेनामी भाग-2)

-

क्या बच्चो, मा-बाप व परिजनों के नाम से संव्यवहार (Transactions) भी बेनामी माने जायेंगे (भाग-3)

क्या बच्चो, मा-बाप व परिजनों के नाम से संव्यवहार (Transactions) भी बेनामी माने जायेंगे (भाग-3)

-

क्या 1 नवम्बर, 2016 के पूर्व के बेनामी निवेश / प्रॉपर्टी बेनामी क़ानून से मुक्त है (भाग-4) ?

क्या 1 नवम्बर, 2016 के पूर्व के बेनामी निवेश / प्रॉपर्टी बेनामी क़ानून से मुक्त है (भाग-4) ?

-

The Prohibition of Benami Property Transaction Act, 1988 / नया बेनामी कानून

The Prohibition of Benami Property Transaction Act, 1988 / नया बेनामी कानून

-

‘बेनामी’ (Benami) व ‘बेनामी संबंधी क़ानून’ (Benami Law) है क्या (भाग-1)

‘बेनामी’ (Benami) व ‘बेनामी संबंधी क़ानून’ (Benami Law) है क्या (भाग-1)

-

देश का एक केबिनेट मंत्री कितना झूठ बोल सकता है – देश के नागरिको को क्या सिखा रहे है ?

देश का एक केबिनेट मंत्री कितना झूठ बोल सकता है – देश के नागरिको को क्या सिखा रहे है ?

-

जीएसटी में केसी-केसी व कितनी-कितनी है पेनेल्टिया – Various Penalties in GST.

जीएसटी में केसी-केसी व कितनी-कितनी है पेनेल्टिया – Various Penalties in GST.

-

क्या कोई देश बिना आयकर, जीएसटी, पेयजल व खेती की जमीन के भी विकसित देश हो सकता है – हां !

क्या कोई देश बिना आयकर, जीएसटी, पेयजल व खेती की जमीन के भी विकसित देश हो सकता है – हां !

-

गुजरात में कांग्रेस राज्य सभा का चुनाव हार जायेगी – आयकर की रेड दिखायेगी कमाल ?

गुजरात में कांग्रेस राज्य सभा का चुनाव हार जायेगी – आयकर की रेड दिखायेगी कमाल ?

-

आधुनिक विज्ञान से विकास हो रहा हैं या विनाश – भारतीय पुरातन ज्ञान (भाग-28)

आधुनिक विज्ञान से विकास हो रहा हैं या विनाश – भारतीय पुरातन ज्ञान (भाग-28)

-

देश की एक बड़ी सीमेंट कंपनी दिवालिया घोषित – Cement Company Declared Bankrupt.

देश की एक बड़ी सीमेंट कंपनी दिवालिया घोषित – Cement Company Declared Bankrupt.

-

आयकर व पुलिस की नजर में डायरी में एंट्री का क्या मतलब हो सकता है ?

आयकर व पुलिस की नजर में डायरी में एंट्री का क्या मतलब हो सकता है ?

आदर्श क्रेडिट कोपरेटिव सोसाइटी (Adarsh Credit Cooperative Society) की प्रॉपर्टीज को RDB ग्र�...

आदर्श क्रेडिट कोपरेटिव सोसाइटी (Adarsh Credit Cooperative Society) की प्रॉपर्टीज को RDB ग्रुप को 9711 करोड़ में बेचने का झूठा व फर्जी सौदा भी कैंसिल ...

- सावधान ! ‘ नापतोल ’ ऑनलाइन शौपिंग पर हो रही है खुल्ली ठगी – Open cheating on naaptol.c...

- आदर्श क्रेडिट कोपरेटिव सोसाइटी (Adarsh Credit Cooperative Society – Accsl) द्वारा 43% कमीशन सिर�...

- आदर्श क्रेडिट कोपरेटिव सोसाइटी (Adarsh Credit Cooperative Society – Accsl) द्वारा 4 लाख लोगो क�...

- आदर्श क्रेडिट कोपरेटिव सोसाइटी (Adarsh Credit Cooperative Society) की प्रॉपर्टीज को RDB ग्र�...

- फेस बुक पर ‘Naya Bharat Party’ (नया भारत पार्टी ) के पसंदकर्ताओं (Likers) की संख्य�...

- आदर्श क्रेडिट कोपरेटिव सोसाइटी (Adarsh Credit Cooperative Society) से मोदी परिवार ने वेतन ...

- आदर्श क्रेडिट कोपरेटिव सोसाइटी (Adarsh Credit Cooperative Society) से 3 साल में मुकेश मोदी (...

- आदर्श क्रेडिट कोपरेटिव सोसाइटी (Adarsh Credit Cooperative Society) के पूर्व-प्रबंध (Ex-management) �...

- तीन लाख फर्जी कंपनियों को बंद कराने का कालाधन (Black Money) व नोटबंदी (Demonetization) स...

-

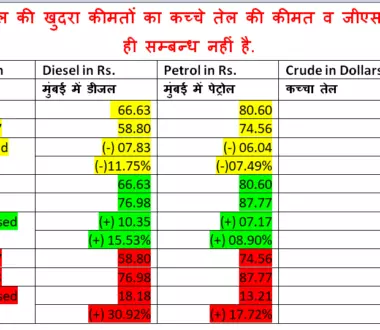

पेट्रोल-डीजल की खुदरा कीमतों के निर्धारण में जनता को लूटा जा रहा है – ...

पेट्रोल-डीजल की खुदरा कीमतों के निर्धारण में जनता को लूटा जा रहा है – ...

-

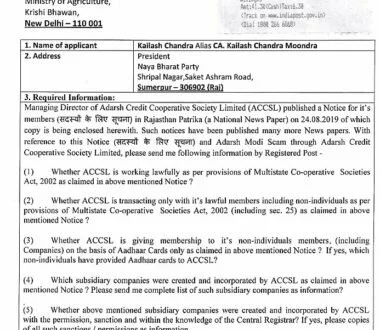

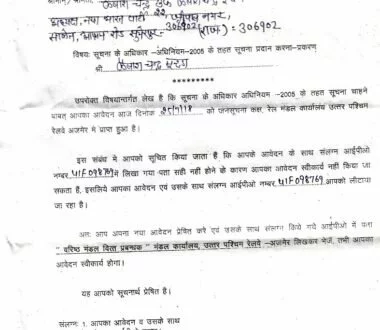

आदर्श क्रेडिट कोपरेटिव सोसाइटी द्वारा प्रकाशित ‘सदस्यों हेतु सूचन�...

आदर्श क्रेडिट कोपरेटिव सोसाइटी द्वारा प्रकाशित ‘सदस्यों हेतु सूचन�...

-

जबावदारी से दूर भागता भारतीय रेलवे, आर.टी.आई के प्रति बेरहम .

जबावदारी से दूर भागता भारतीय रेलवे, आर.टी.आई के प्रति बेरहम .