Income Declaration Scheme As Emergency In The Income Tax World

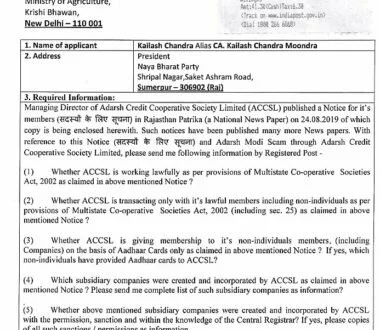

Manish Mewara from Jaipur : Recently, an online Book of CA. K.C.Moondra on Income Declaration Scheme has been published. In the chapter-12 of this book, author has explained how the Central Govt. has declared emergency in the Income Tax World after the emergency of 1975. As per this book, assessments older than 6 years since 01.04.1940 can be re-opened.

We will take the readers back in the year 1975 when Emergency was declared in India after a decision of Allahabad High Court against Late Smt. Indira Gandhi, Ex-Prime Minister of India. Many readers might not have opportunity to see / face the Emergency Regime when almost all civil rights of Indian Citizens were suspended and a Danda Raaj was prevailing throughout the country. Many political as well as social leaders opposing Emergency Regime were put behind the bars. That Emergency was withdrawn in 1977 and thereafter, safeguards were created by Janata Party Government. Resultantly, emergency was never repeated in India.

After the Emergency of 1975, Authors feel and realize that limited Emergency in the ‘limited world of Income Tax’ will be seen / faced in India after 30th September, 2016, the last date of declaration under the Income Declaration Scheme, 2016. As discussed in previous two chapters, all cases of non-declarants will be re-opened u/s 148 of the Income-tax Act, 1961 if the Assessing Officer (ITO) satisfies himself that any person of India failed in declaring undisclosed income / assets earned and / or acquired after 01.04.1940.

By the provisions of Finance Act, 2016 (The Income Declaration Scheme, 2016) and subsequent circulars, Government of India has suspended provisions of sec. 149 of the Income-tax, 1961. As per provisions of sec. 149, no case older than 6 years can be reopened but after suspension of provisions of sec. 149 as per ‘threats of Leaders’ of Indian Government, even 70 years old case can also be re-opened.

We have termed this ‘Suspension of provisions of sec. 149’ as ‘Emergency in The Income Tax World’. Not only an average Indian but our learned Parliamentarians also could not understand the Hidden Agenda of FM Arun Jaitaly of ‘Emergency in the Income Tax World’ and they also accepted / passed the Income Declaration Scheme, 2016 within the Finance Bill, 2016 by closing their eyes on such serious provisions.

Authors understand that they are using very harsh / extreme words ‘Emergency in The Income Tax World’ but we think that following few imaginary examples will justify their words –

- ‘B’ makes a complaint (Naami or Benami) to an Income-tax Officer alleging that he made payment of an income of Rs. 1.00 Crore to ‘A’ on 01.01.2001 and in support of his complaint, he files a computerized account statement (Signed or Unsigned). On the basis of this Naami or Benami complaint, ITO issues case re-opening notice. Now, after removal of barrier of sec. 149, The ITO will proceed to re-assess the Income of ‘A’ after more than 15 years.

This example is not excessive. It is possible. In an actual case in the office of Income-tax Office, Sumerpur (Rajasthan), ITO re-opened the case u/s 148 of the Income-tax Act. In that case, case was re-opened on the basis of false & unsigned computerized account statement without even any inquiry.

- ‘X’ constructed a house before 25 years. His neighbor ‘Y’ made complaint to ITO saying that there was unexplained investment of Rs. 10.00 Lakhs by ‘X’ in construction of house and in the interior decoration. ITO makes a case and reopens the case. During the assessment, ITO asks for details of all constructions and sources of investment. ‘X’ says that since the matter is more than 6 years old, he has not kept any record, document and proof. In absence of any such record, ITO may make the assessment as per his own satisfaction.

- A photo copy of an agreement of sale of property between ‘D’ (Seller) and ‘C’ (Buyer) dated 01.01.1965 is received by an ITO through any source. ITO reveals the difference between the sales amounts mentioned in registered sale deed and in the copy of agreement. Now, ITO re-opens this case of A.Y. 1965-66 and makes the assessment in his own way.

- An assessee (Tax Payer) receives a call / communication from a corrupt and notorious ITO regarding 25 years old undisclosed / concealed income in the eyes of ITO and he demands bribe to ignore the matter. Now, either such assessee will have to pay bribe or will have to face re-opening proceeding because now, ITO has power to reopen 25 year old case also.

- If any ITO raises finger over any old constructed building in India, such each ITO will be successful in making out a case as average assessee will not be able to justify himself as assessee does not maintain books of accounts for the year older than 6 years.

- If a case is re-opened for the construction of house before 20-30 years by a farmer having even having no PAN Number by an ITO, how that farmer will prove the investment / source of construction of house in absence of any record and accounts.

In such circumstances, All the Income-tax Authorities will be extremely powerful and unlimited corruption & harassment will increase among the civil society. At least each and every building owner (constructed in last 70 years) will be on the radar of an ITO. No doubt, everything will be subject to appeal and opportunity but everything will be on the cost of harassment of Indian Citizens for the forgotten / concluded issues.

Author are very hopeful that such arbitrary provisions will be quashed by Indian Judiciary and this ‘So Called Emergency’ will come to end and happiness in the society at large will be restored by the Indian Judiciary.